Information for executors

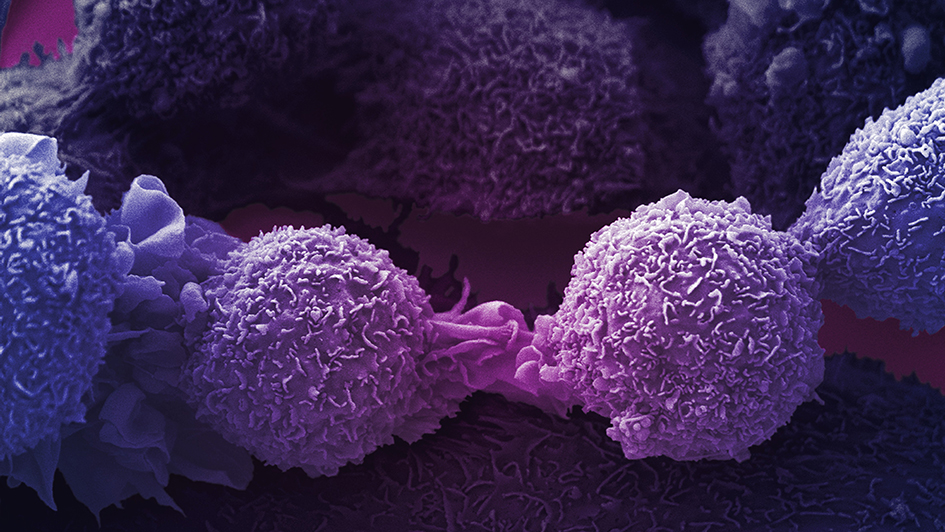

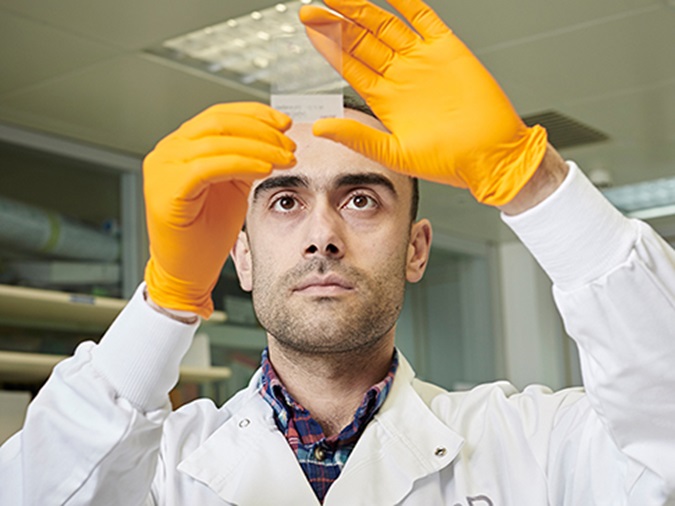

We are incredibly grateful to those who have included a gift in their Will to support our research. Their generosity helps our scientists, researchers, and clinicians to continue to find the treatments that help patients live longer and well with cancer. To find out more about where this vital income will be used, read more about our strategy to defeat cancer.

We understand that dealing with someone’s estate can be daunting, especially if you have not done it before. You also may be dealing with your own grief. We are here to help you fulfil the wishes of the deceased as set out in their Will.

Although we cannot provide legal advice, we will try our best to help you. If you have any questions, please call our Legacy Team on 020 7153 5387 or you can send an email to [email protected].

Main duties of an executor

- Registering the death with the authorities

- Obtaining copies of the Will

- Arranging the funeral

- Looking after the assets of the estate until they are disposed of

- Valuing the estate

- Sorting out finances

- Selling or disposing of assets

- Paying Inheritance Tax*

These duties can take several months to complete, depending on the complexity of the estate. You may find it helpful to use a solicitor who can provide legal advice and guidance in your role. Find a solicitor via The Law Society.

Explanation of terms

The language used in Wills is technical and can be difficult to understand. Below are explanations of the most common terms:

Inheritance Tax:

A tax on the property, money and possessions of a person who has died. You can find out more about how Inheritance Tax works, the thresholds, rules, and allowances on gov.uk.

Probate:

This is the legal right of an executor to deal with someone’s property, money, and possessions when they die. The deceased’s estate cannot be disposed of until Probate has been granted. You can read more about how to obtain Probate on gov.uk.

Bequest:

The act of giving or leaving something in a Will

Pecuniary:

A fixed amount of money left in a Will

Residuary:

A share or percentage of an estate once all other bequests, expenses and taxes are paid

Specific:

A physical item such as jewellery, stocks, shares, artwork, property etc.

Reversionary trust:

Someone who can benefit from the estate during their lifetime e.g., live in or use a property, when they die the asset is then given (reverts) to the charity

Ways you can pay a gift in a Will to us

By cheque

Make the cheque payable to ‘The Institute of Cancer Research’ and send to:

The Legacy Officer

The Institute of Cancer Research

123 Old Brompton Road

LONDON

SW7 3RP

Please include a covering letter with the name and address of the deceased, so that we can find them in our records and remove them from the mailing list, so that we do not cause distress by sending correspondence to them.

Direct into our bank account

Our bank details are: Account Name: The Institute of Cancer Research Sort Code: 40-05-14 Account No: 00476110 Please include the name of the deceased in the reference.

It would also be helpful if you could send an email to [email protected] (contact form) to let us know when we can expect the legacy so that we can allocate it correctly. Please include the name and address of the deceased, and the amount or type of gift.

Related news

.png?sfvrsn=364266fe_1)

‘Smart jab’ shows promise in treating advanced head and neck cancer

New drug shows dramatic effect in shrinking lung cancer tumours

Will for Free

Will for Free allows you to make a professionally-written Will, free of charge and enables us to raise vital funds for our world-leading cancer research.

Make a Will Online

We have partnered with Make a Will Online to enable you to create a simple Will digitally – checked by a qualified solicitor – at no cost to you.

Legacy supporters

If they’re giving up their time for us, donating monthly or helping us in another way, we think all of our supporters are amazing and we want to share their stories.

National Free Wills Network

We have partnered with the National Free Wills Network, which puts you in touch with a solicitor near you.